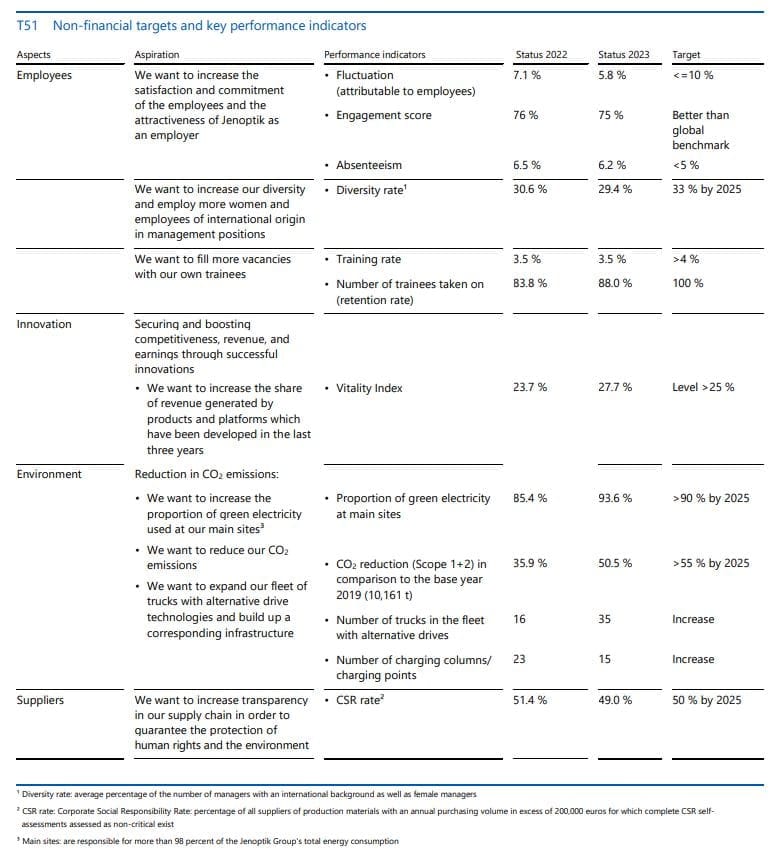

Sustainability targets for Jenoptik

Jenoptik is actively committed to greater sustainability and has set various non-financial targets, some of which are taken into account in the executive remuneration. Our group financing is also geared towards these goals.

We are particularly focused on the following topics (target by 2025):

More green electricity

Proportion of green electricity

(2023: 93.6 %)

Increase the proportion of green electricity

By increasing the proportion of green electricity to more than 90% by 2025, we aim to reduce our CO2 emissions and contribute to greater environmental protection.

Reduced emissions

Reducing CO2 emissions

(2023: -50.4 %)

Reduction of our CO2 emissions

By 2025, we want to reduce our direct and indirect CO2 emissions (Scope 1+2) by more than 55 percent, compared to the year 2019. We also want to achieve climate neutrality (net-zero) with regard to Scope 1+2 emissions by 2035, i.e. those emissions that we ourselves directly influence.

More innovation

Vitality index

(2023: 27.7 %)

Increasing competitiveness through successful and sustainable innovations

As a high-tech company, our share of sales with new products, known as Vitality Index, should be at a level of more than 25% by 2025.

More diversity

Diversity rate

(2023: 29.4 %)

Greater diversity within the company

We signed the Charter of Diversity and want to increase the diversity rate, i.e., increase the proportion of women in management and international managers in the company to 33% by 2025.

Greater supply chain visibility

CSR rate

(2023: 49.0 %)

More transparency in the supply chain to ensure the protection of human rights and the environment

By 2025, the proportion of suppliers of production materials with complete and non-critical self-assessments should be 50 percent.

*CSR Rate = Corporate Social Responsibility Rate

Green finance: sustainability in group financing

Sustainability is also playing an increasing role in the capital market and more and more investors are investing their money in sustainable investments.

In spring 2021, Jenoptik placed a new debenture bond of over 400 million euros with sustainability components – in the form of concretely verifiable targets for the environment (green electricity rate), social aspects (diversity of managers) and governance (sustainability in the supply chain).

If all three targets are reached, Jenoptik receives a small amount of interest; conversely, a penalty must be borne if less than two of the three targets are achieved. A “win-win-win” for investors, companies and the environment, so to speak. The attractive conditions reflect the very good creditworthiness of the Jenoptik Group, and the capital measures enable Jenoptik to continue to provide a very solid, long-term and broad financing base.

The successful placement of 400 million euros – twice as much as originally planned – reflects the high level of confidence investors have in Jenoptik.

In addition, Jenoptik refinanced its revolving syndicated loan in December 2021 and aligned it with the Group’s ESG goals. With a term of five years and the loan volume increased from 230 to 400 million, it has been possible to secure additional financing options at attractive conditions in the long term. The term can be extended twice by one year each (5+1+1) and the volume increased to 600 million euros if necessary.